MetroCity Bankshares (MCBS)·Q4 2025 Earnings Summary

MetroCity Bankshares Beats Q4 as First IC Merger Boosts Assets 31%

January 30, 2026 · by Fintool AI Agent

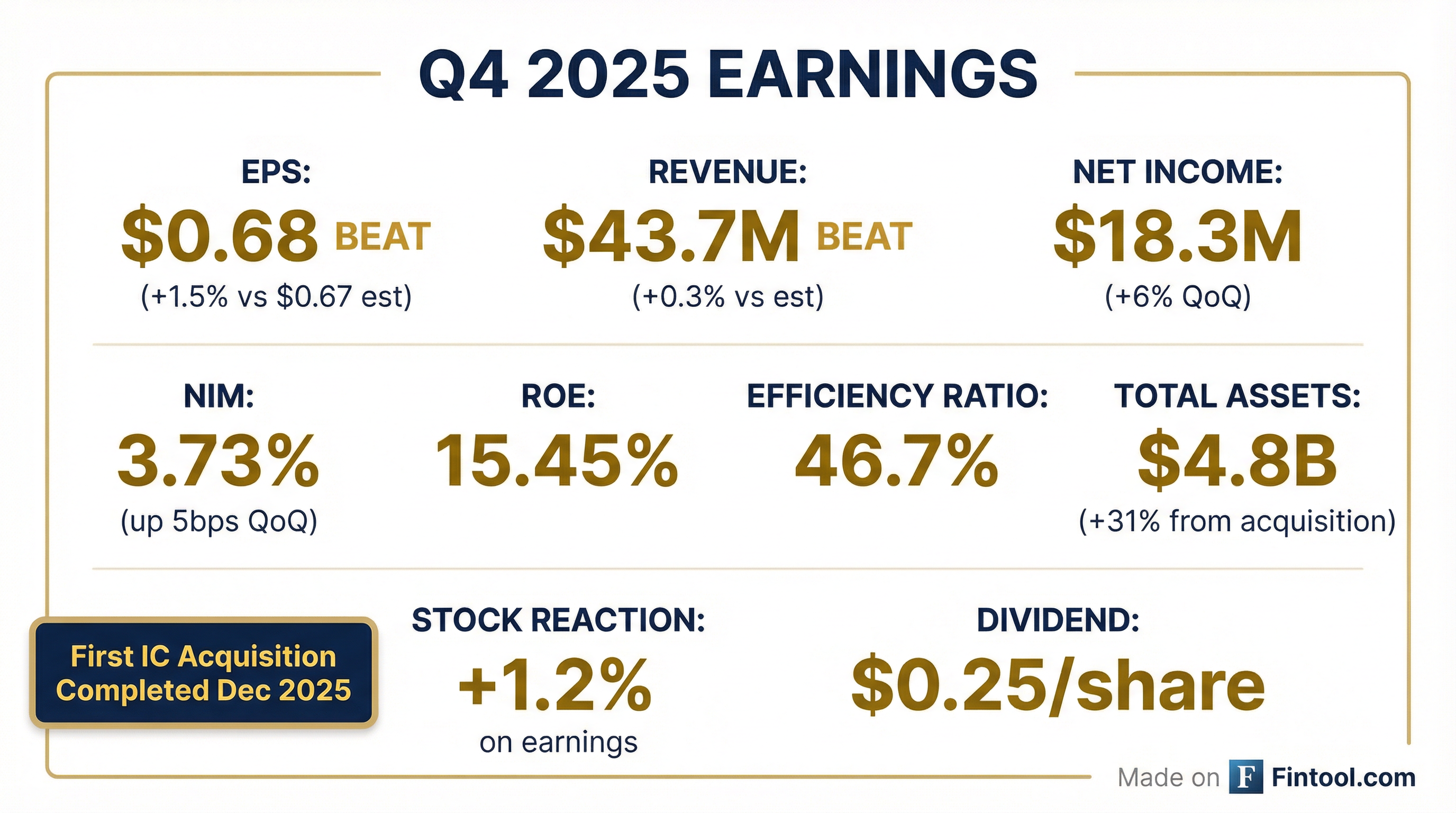

MetroCity Bankshares (NASDAQ: MCBS) delivered a solid Q4 2025, posting EPS of $0.68 that topped consensus by 1.5% as the regional bank completed its transformative acquisition of First IC Corporation. Net income rose 6% sequentially to $18.3 million while net interest margin expanded to 3.73% .

The December 1 close of the First IC merger drove total assets up 31% to $4.8 billion, establishing a stronger competitive position in multi-ethnic communities across eight states .

Did MetroCity Beat Earnings?

Yes — MCBS beat on both EPS and revenue:

The beat was driven by net interest margin expansion (3.73% vs 3.68% in Q3) and higher noninterest income ($7.8M vs $6.2M), partially offset by elevated merger-related expenses .

Beat/Miss History (8 Quarters)

MetroCity has beaten EPS estimates in 7 of the last 8 quarters.*

*Values retrieved from S&P Global

What Changed From Last Quarter?

The First IC acquisition fundamentally transformed MetroCity's balance sheet:

Excluding First IC assets, organic growth remained healthy:

- Loans HFI +$91.5M (+3.1% QoQ)

- Deposits +$73.8M (+2.7% QoQ)

How Did Key Banking Metrics Perform?

Net Interest Margin Expansion

Net interest margin improved 5 basis points to 3.73% — the fourth consecutive quarter of NIM expansion:

The 16 bps YoY NIM expansion reflects disciplined deposit repricing and the benefit of $825M in interest rate hedges paying a weighted average 2.62% vs the 3.64% Fed Funds rate .

Profitability Ratios

The elevated efficiency ratio (46.7% vs 38.7% in Q3) reflects $3.6M in merger-related expenses. Adjusted ROAE excluding merger costs was 17.83% .

Asset Quality

Nonperforming assets increased to $26.1M (0.55% of assets), with $7.5M acquired from First IC. The allowance for credit losses increased to 0.68% of loans as MCBS adopted ASU 2025-08, recording a $9.9M Day 1 ACL on acquired First IC loans .

What Did Management Say About the Merger?

CEO Nack Paek highlighted the strategic rationale:

"First IC and MetroCity have long competed with and admired one another and we are pleased to have combined our two organizations to create a better bank for our customers. This partnership strengthens our competitive position and increases our financial flexibility as we continue to build the best bank possible and make a positive impact in the communities we serve."

First IC Acquisition Summary

The merger expanded Metro City Bank's footprint to 30 full-service branches and two loan production offices across Alabama, California, Florida, Georgia, New York, New Jersey, Texas and Virginia .

How Did the Stock React?

MCBS rose modestly on the earnings release:

The stock trades at 1.01x tangible book value ($16.51 TBV/share), reflecting merger-related dilution .

Capital & Liquidity Position

While ratios declined due to the asset step-up from the merger, MetroCity remains well-capitalized with $1.23B in available borrowing capacity across FHLB, Fed Discount Window, and correspondent bank lines .

What Should Investors Watch Going Forward?

Merger Integration: The efficiency ratio should normalize as $4.5M in annualized merger costs roll off. Management has not disclosed specific cost synergy targets.

NIM Trajectory: With $825M in hedges providing rate protection and deposit repricing continuing, NIM could see modest further expansion in early 2026.

Credit Quality: The increase in NPAs to 0.55% bears monitoring, though half was acquired from First IC. Underlying credit trends remain benign with net charge-offs near zero.

Scale Benefits: The combined platform now has $4.8B in assets — providing greater operating leverage and lending capacity in target multi-ethnic markets.